SushiSwap Exchange is a prominent decentralized exchange (DEX) built on Ethereum that has become a key player in the DeFi ecosystem. Launched in 2020, SushiSwap operates using an automated market maker (AMM) model, enabling users to trade tokens without intermediaries. With features like token swapping, yield farming, staking, and cross-chain integration, SushiSwap offers a diverse range of services. It gained attention early on due to its controversial beginnings, with the anonymous founder “Chef Nomi” withdrawing treasury funds before handing over the project to Sam Bankman-Fried. Despite this rocky start, SushiSwap has evolved significantly, adding innovative features like Sushi X Swap, which facilitates seamless cross-chain token exchanges.

The trading platform’s low fees—set at 0.3% per transaction, with 0.25% allocated to liquidity providers—make it an attractive option for users seeking to maximize returns. Users can also participate in the SushiSwap earn program by staking SUSHI tokens, earning additional rewards in a secure environment. However, SushiSwap has faced challenges, including a SushiSwap exploit in 2021, which raised concerns about its security. Since then, the platform has enhanced its smart contracts and introduced robust safeguards to ensure user safety. Comparisons like SushiSwap vs. PancakeSwap highlight key differences: SushiSwap operates on Ethereum, offering a broader ecosystem but higher gas fees, whereas PancakeSwap is on Binance Smart Chain (BSC), with lower transaction costs.

Once a dominant force in DeFi with over $4 billion in Total Value Locked (TVL) in 2021, SushiSwap’s TVL has since declined to $1.51 billion in 2023, reflecting a 62% drop. Despite the decline, SushiSwap remains competitive, integrating with Layer-2 solutions like Polygon and Arbitrum for faster, cost-efficient transactions. SushiSwap Exchange reviews on Reddit and Trustpilot often praise its innovations and earnings potential while cautioning against the complexity and high gas fees. Whether you’re learning how to use SushiSwap, exploring its swap fee structure, or comparing it to other DEXs, SushiSwap remains a versatile and innovative platform. Its continued focus on cross-chain capabilities, user rewards, and ecosystem growth positions it as a key player in DeFi’s future.

Founders And Origin Story OF SushiSwap

A Deep Dive Into Its Controversial History Of SushiSwap

SushiSwap Exchange is one of the most talked-about decentralized exchanges (DEX) in the DeFi space, offering token swaps, yield farming, and staking. However, its journey has been anything but smooth, marked by scandals and significant milestones. Here’s the full story, incorporating key terms like what is SushiSwap, SushiSwap fee, and how to use SushiSwap, while addressing comparisons like SushiSwap vs PancakeSwap and events like the SushiSwap exploit.

The Early Days: SushiSwap’s Creation

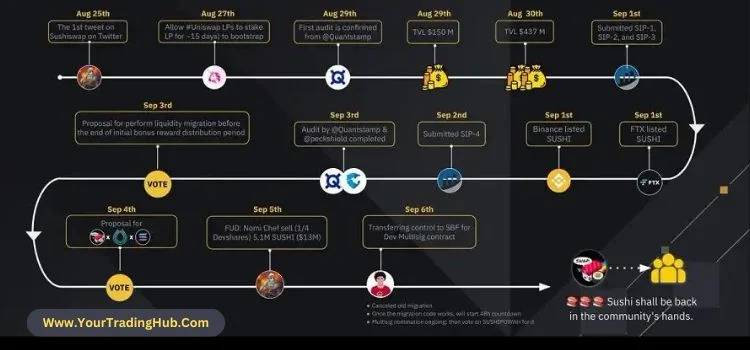

Launched by two anonymous developers, SushiSwap debuted without an official audit. Despite this, Chef Nomi, one of the creators, invited auditing firms like Quantstamp and Consensys to review its code. Within a week, SushiSwap amassed over $1 billion in locked funds, briefly surpassing Aave as the largest DeFi protocol. Interest rates on locked funds hit an astonishing 2,500% APY, drawing attention to the platform.

The Chef Nomi Exit Scandal

On September 5, 2020, Chef Nomi liquidated $14 million worth of SUSHI tokens from the development fund. Claiming entitlement to the funds, Chef Nomi’s actions outraged the crypto community, including yearning. finance creator Andre Cronje. Popular YouTuber Ivan on Tech described SushiSwap as “just as bad as real sushi,” noting its adverse impact on the cryptocurrency market.

After facing immense backlash, Chef Nomi handed over control of SushiSwap to Sam Bankman-Fried, founder of FTX. The SushiSwap community voted for nine DeFi leaders, including Compound Finance’s Robert Leshner, to manage the project’s multi-signature wallet for development funds.

SushiSwap’s Vampire Attack on Uniswap

On September 9, 2020, SushiSwap executed a planned “vampire attack” on Uniswap, migrating $1.14 billion of Uniswap’s $1.9 billion locked assets to SushiSwap. This move temporarily made SushiSwap the largest DEX, showcasing its ability to challenge giants like Uniswap and sparking comparisons between the two.

Chef Nomi Returns

In a surprising turn on September 11, 2020, Chef Nomi returned the $14 million in development funds, sparking speculation about his motives. Some believe this was a publicity stunt, while others suggest it followed pressure from key figures like 0xMaki, a core SushiSwap contributor. Chef Nomi has since stepped away from the project, referring to himself as SushiSwap’s “former head chef.”

What Is SushiSwap?

SushiSwap is a decentralized cryptocurrency exchange (DEX) built on the Ethereum blockchain. It serves as an evolution of Uniswap, offering a similar interface and functionality with added features to enhance user experience. The platform allows users to swap tokens, provide liquidity, and earn rewards through SUSHI tokens, an ERC-20 token used for governance and additional staking rewards. Designed to be community-driven, SushiSwap empowers its users by letting them vote on key proposals, making it a truly decentralized platform.

Despite its controversial beginnings, SushiSwap remains committed to the open-source ethos of cryptocurrency. All smart contracts and codes are publicly accessible via GitHub and Medium posts, ensuring transparency and trust. Borrowing code from successful DeFi protocols like Uniswap, Compound Finance, and Yam Finance, SushiSwap has built a robust platform that attracts both traders and liquidity providers. The platform has also been audited by PeckShield and reviewed by Quantstamp, which reinforces its credibility and security.

SushiSwap stands out by rewarding liquidity providers with SUSHI tokens, which can be staked or used for governance. Its community-driven approach sets it apart, fostering a collaborative ecosystem where users collectively govern the platform’s operations and funds. While SushiSwap competes directly with Uniswap, it offers additional features like multi-chain support, expanding its utility beyond Ethereum. Whether you’re exploring how to use SushiSwap, understanding SushiSwap fees, or comparing SushiSwap vs PancakeSwap, it remains a top choice for DeFi enthusiasts seeking innovation and transparency.

DEX vs. AMM Explained

Before diving into the details of SushiSwap Exchange, it’s essential to understand the fundamental concepts of DEXs and AMMs, which form the backbone of platforms like SushiSwap, Uniswap, and others.

What is a DEX?

DEX stands for Decentralized Exchange, a platform where users can trade cryptocurrencies without a middleman (e.g., centralized exchange). Below is a summary of its key features:

| Feature | Description | Example |

|---|---|---|

| No Intermediaries | Users trade directly with one another via smart contracts. | SushiSwap |

| No Custody | DEXs do not hold users’ assets. | Uniswap |

| No KYC | Users don’t need to verify their identity. | PancakeSwap |

| Types of DEXs | Order Book DEXs (track buy/sell orders) and Liquidity Pool DEXs (use liquidity pools). | SushiSwap |

What Is An AMM?

AMM stands for Automated Market Maker, a mechanism that powers most DEXs, including SushiSwap Exchange. AMMs enable trading without traditional buy/sell orders, relying instead on liquidity pools and mathematical functions to determine prices.

| Term | Explanation | Example |

|---|---|---|

| Liquidity Pool | A pool of two tokens funded by liquidity providers (LPs). | ETH/SUSHI on SushiSwap |

| Price Determination | Prices are calculated by the Constant Product Formula: x * y = k. | x = Token A, y = Token B |

| Bonding Curve | A graph of the AMM function shows how prices change as the ratio of assets in the pool changes. | SushiSwap Docs |

Constant Product Formula

The constant product formula x * y = k ensures that the product of the quantities of the two assets in the pool (k) remains constant. This creates a bonding curve, preventing anyone from draining the pool entirely.

| Component | Description |

|---|---|

| x | Quantity of one token in the pool. |

| y | Quantity of the other token in the pool. |

| k | Constant product of x and y. |

| Impact on Price | As one token’s supply increases, its price decreases relative to the other. |

Why Are DEXs and AMMs Important for SushiSwap?

DEXs like SushiSwap Exchange leverage AMMs to provide a seamless trading experience:

- Efficient Trading: No need for buyers/sellers to match orders.

- Decentralization: No central authority controls user funds or enforces restrictions.

- Liquidity Rewards: Users earn fees and rewards by providing liquidity to pools (SushiSwap Earn).

SushiSwap vs. Uniswap: A Detailed Comparison

SushiSwap Exchange and Uniswap are two of the most prominent decentralized exchanges (DEXs) in the DeFi space. While SushiSwap originated as a fork of Uniswap, the platforms have since evolved to offer unique features. Below is a detailed comparison highlighting their differences and similarities using keywords like what is SushiSwap, SushiSwap fee, SushiSwap a decentralized exchange, and more.

Key Differences Between SushiSwap and Uniswap

| Feature | SushiSwap | Uniswap |

|---|---|---|

| Liquidity Provision Rewards | – Early adopters earn 10x SUSHI rewards via Sushi Bar. – Rewards are sustainable even after liquidity provision stops. |

– Rewards are proportional to liquidity provided. – Large providers (e.g., exchanges) dominate earnings. |

| Multi-Chain DEX | Operates on over 16 blockchain networks, including Ethereum, Polygon, BSC, Fantom, and more. | Limited to Ethereum, Polygon, Optimism, and Arbitrum. |

| Additional Features | Offers diverse features like: – Kashi (Lending & Leverage) – Sushi Bar (Staking) – BentoBox (Token Vault) – MISO (IDO Launchpad). |

Primarily focused on AMM and liquidity pool farming. |

| Fee Structure | The sushiSwap fee includes 0.3% per trade, with 0.05% distributed to SUSHI holders. | Uniswap charges 0.3% per trade without direct reward to platform token holders. |

| Community Governance | Community-driven with active participation in decision-making and protocol upgrades. | Community participation through UNI governance tokens. |

SushiSwap’s Unique Advantages

- What is SushiSwap Used For?

Beyond swapping tokens, SushiSwap allows users to earn SUSHI, participate in staking, and access advanced features like Kashi for leveraged trading. - Multi-Chain Capabilities

SushiSwap supports over 16 networks, making it highly versatile compared to Uniswap’s limited coverage. - Innovative Features

Tools like BentoBox and MISO make SushiSwap a comprehensive platform for DeFi services.

SushiSwap’s Limitations Compared to Uniswap

- Reputation Issues

The SushiSwap exploit during its early days caused skepticism, although the platform has since matured. - Adoption and Liquidity

Uniswap retains a larger user base and higher total locked liquidity, making it a stronger contender for some traders.

While SushiSwap and Uniswap share a similar foundation, SushiSwap’s expanded features, multi-chain compatibility, and innovative incentives like SUSHI rewards set it apart. Traders looking for versatility and advanced tools may prefer SushiSwap, while those prioritizing simplicity and Ethereum dominance might lean toward Uniswap.

SushiSwap Pros and Cons

How Does SushiSwap Work?

SushiSwap Exchange is a versatile decentralized exchange (DEX) built on Ethereum and other blockchain networks. It offers features like token swaps, liquidity farming, staking, and governance. Below is a detailed explanation of how SushiSwap operates, using all relevant keywords.

SushiSwap Overview

| Feature | Description |

|---|---|

| What is SushiSwap? | SushiSwap is a decentralized exchange (DEX) leveraging Automated Market Maker (AMM) technology for token swaps. |

| Is SushiSwap a DEX? | Yes, SushiSwap operates without a central authority, enabling secure peer-to-peer transactions. |

| SushiSwap Fee | Charges a 0.3% trading fee, with 0.25% going to liquidity providers and 0.05% to Sushi Bar takers. |

| SushiSwap Explained | SushiSwap allows swapping, staking, farming, and governance through its innovative DeFi tools. |

| How to Use SushiSwap | Connect a Web3 wallet like MetaMask, select tokens to trade, and pay gas fees to execute transactions. |

SushiSwap Key Components

| Component | Description |

|---|---|

| Automated Market Maker | Uses liquidity pools of token pairs (e.g., ETH/LINK) to determine prices based on token ratios. |

| Liquidity Pools | Allow users to deposit token pairs, earn trading fees, and receive Sushi Liquidity Pool (SLP) tokens. |

| SUSHI Farming | Users earn SUSHI tokens by staking Uniswap LP tokens in SushiSwap pools during its launch phase. |

| Limit Order V2 | Lets users set buy/sell orders at predefined prices without locking underlying funds. |

| BentoBox Vault | A token vault that provides additional yield through flash loans and integrated dApps like Kashi. |

SushiSwap Features And Applications

| Feature | Description |

|---|---|

| SushiSwap Earn | Earn rewards by staking SLP tokens in farming pools or xSUSHI tokens in Sushi Bar. |

| Onsen Menu | A system to incentivize liquidity provision for newer tokens using SUSHI rewards. |

| Kashi Lending | A lending and leverage platform enabling isolated lending markets for various tokens. |

| MISO Launchpad | A platform for launching new tokens and NFT projects using open-source smart contracts. |

SushiSwap Innovations And Governance

| Innovation | Description |

|---|---|

| Trident Framework | A framework for developing custom AMMs to enhance liquidity pool functionality. |

| SushiPowah Voting | Governance system where users vote on proposals using SUSHI or xSUSHI tokens. |

| SushiSwap Exploit | SushiSwap’s early controversies included a “vampire attack” on Uniswap and an exit scam by Chef Nomi. |

| SushiSwap vs PancakeSwap | SushiSwap operates on Ethereum, while PancakeSwap uses Binance Smart Chain with lower fees. |

SushiSwap Trading Options

| Trading Option | Description |

|---|---|

| Instant Swapping | Users deposit one token and withdraw another instantly using liquidity pools. |

| Limit Orders | Capital-efficient orders are executed when tokens hit a specified price. |

SushiSwap At A Glance

| Summary | Details |

|---|---|

| How to Buy SushiSwap | Purchase SUSHI tokens on major exchanges or directly on SushiSwap. |

| SushiSwap Review | Widely regarded as innovative but previously controversial due to early exploits. |

| SushiSwap Trustpilot | Mixed reviews, with users praising its functionality but noting high gas fees on Ethereum. |

SushiSwap’s comprehensive ecosystem combines trading, staking, lending, and governance, making it a versatile player in the DeFi space. While SushiSwap vs Uniswap comparisons are frequent, SushiSwap’s additional features like BentoBox and Onsen Menu set it apart. Let me know if you’d like further refinements!

The SUSHI Token Explained

The SUSHI token, central to the SushiSwap Exchange, plays a crucial role in liquidity provision, governance, and rewards within the decentralized exchange (DEX) ecosystem. Here’s a breakdown of its functionality, history, and market presence.

Key Features Of the SUSHI Token

| Feature | Details |

|---|---|

| Token Type | ERC-20 |

| Earned Through | Providing liquidity to SushiSwap pools or farming for SLP tokens used in protocol governance. |

| Governance | SUSHI holders vote on protocol changes via governance. |

| Staking | SUSHI can be staked on Sushi Bar to earn additional rewards. |

SUSHI Tokenomics

| Metric | Details |

|---|---|

| Initial Issuance | Started at Ethereum block #10750000. |

| Initial Rewards | 1,000 SUSHI per block (later reduced to 100/block). |

| Circulating Supply | 241,099,876 SUSHI tokens. |

| Maximum Supply | 250,000,000 SUSHI tokens. |

SUSHI Price History

| Date | Price Movement |

|---|---|

| Aug 28, 2020 | SUSHI launched at near-zero value. |

| Sep 1, 2020 | Price surged to over $12 as yield farmers joined SushiSwap. |

| Sep 2, 2020 | Crashed 50% to $6. |

| Sep 5, 2020 | Dropped further to $2.50 after Chef Nomi’s $14M sell-off. |

| Mar 2021 | Reached an all-time high (ATH) of $23.38. |

| Current Price | ~$3.27, down 86.04% from its ATH. |

How to Buy SUSHI

| Source | Details |

|---|---|

| Centralized Exchanges | Binance, Huobi, OKX, and more. |

| Decentralized Exchanges | Available on SushiSwap, Uniswap, and other DEXs. |

| Liquidity and Volume | High liquidity and a 24-hour trading volume nearly double its market cap. |

SUSHI Storage Options

| Wallet Type | Recommendation |

|---|---|

| Web 3.0 Wallets | Use wallets like Metamask if participating in liquidity provision or governance on SushiSwap. |

| Secure Wallets | For long-term holding, consider mobile or hardware wallets like Trezor for enhanced security. |

Why SUSHI Matters

- Ecosystem Growth: SushiSwap, with $1.51 billion in total value locked (TVL), remains a key player in DeFi.

- Potential for Recovery: As a leading multichain DEX, SUSHI may return to its previous highs ($20+) as DeFi adoption grows.

- Versatile Use Case: Beyond trading, SUSHI offers staking rewards, governance participation, and liquidity incentives.

Roadmap And Future Vision

SushiSwap Exchange has consistently aimed to establish itself as the premier decentralized exchange (DEX) in the cryptocurrency world. This ambitious vision drives the development team to innovate and expand the platform’s ecosystem. From its turbulent beginnings to its modern advancements, SushiSwap continues to solidify its place in the DeFi space. This extended look at the SushiSwap roadmap highlights past achievements, current innovations, and plans while incorporating keywords like what is SushiSwap, SushiSwap fee, SushiSwap vs PancakeSwap, and more.

SushiSwap’s Vision and Goals

The ultimate goal of SushiSwap is straightforward yet bold: to become the best DEX in the cryptocurrency market. While this is a broad objective, the SushiSwap team continuously works on refining its infrastructure, expanding its ecosystem, and enhancing usability.

SushiSwap’s Past Milestones

The platform’s first visual roadmap appeared in a Medium post on September 12, 2020. Key milestones from SushiSwap’s early development include:

- MISO Upgrades: Short for Minimal Initial Sushi Offering, MISO is a token launchpad designed to simplify creating and launching tokens on SushiSwap.

- Layer-2 Aspirations: SushiSwap has prioritized scaling solutions by planning to integrate Layer-2 technology, reducing fees and increasing transaction speeds.

- AMM 2.0 Infrastructure: Advanced Automated Market Maker (AMM) upgrades aim to improve trading efficiency and liquidity on the platform.

- SushiBar Version 2: A revamped staking mechanism offering better rewards and user experience.

- Wrapped SLP Tokens: Providing additional DeFi utility for liquidity providers by wrapping Sushi Liquidity Pool tokens for broader use cases.

Current Innovations

SushiSwap continues to enhance its features, making it a top choice among decentralized exchanges. These include:

- Sushi X Swap: A cross-chain swap solution enabling seamless token trading across multiple blockchain networks.

- Enhanced Governance: SushiSwap’s governance model, managed by the community and key industry leaders, ensures the platform remains decentralized and innovative.

- Earn with SushiSwap: Features like staking SUSHI in the SushiBar allow users to earn rewards while contributing to the platform’s liquidity.

Future Plans

While SushiSwap’s current team has not detailed specific future milestones, several broad objectives remain central to its roadmap:

- Layer-2 Deployment: Reducing transaction fees and enhancing scalability with solutions like Optimism and Arbitrum.

- Expansion of DeFi Utility: Building tools that improve how to use SushiSwap for advanced traders and DeFi enthusiasts.

- SushiSwap Fee Optimization: Enhancing the SushiSwap swap fee mechanism for greater transparency and user rewards.

Conclusion: SushiSwap Exchange Review

Despite its turbulent beginnings and initial controversies, SushiSwap Exchange has managed to solidify its position as a major player in the DeFi ecosystem. The platform retains approximately $800 million of the $1.14 billion in liquidity it migrated from Uniswap during its infamous “vampire attack” and consistently handles an impressive daily trading volume of $150 million.

SushiSwap has grown beyond its chaotic origins to become one of the most prominent decentralized exchanges (DEX), offering versatile features such as yield farming, liquidity pool (LP) solutions, and seamless token swaps. With its unique governance model, underpinned by a dedicated team of developers and a passionate community, SushiSwap continues to demonstrate resilience and adaptability.